In the world of finance, risk is a crucial companion on the path to financial prosperity . Understanding and managing financial risk is essential for everyone, whether you are an individual investor, a business owner, a financial manager, or a student for that matter. This blog will examine the idea of financial risk, as well as its various categories.

What is Financial Risk?

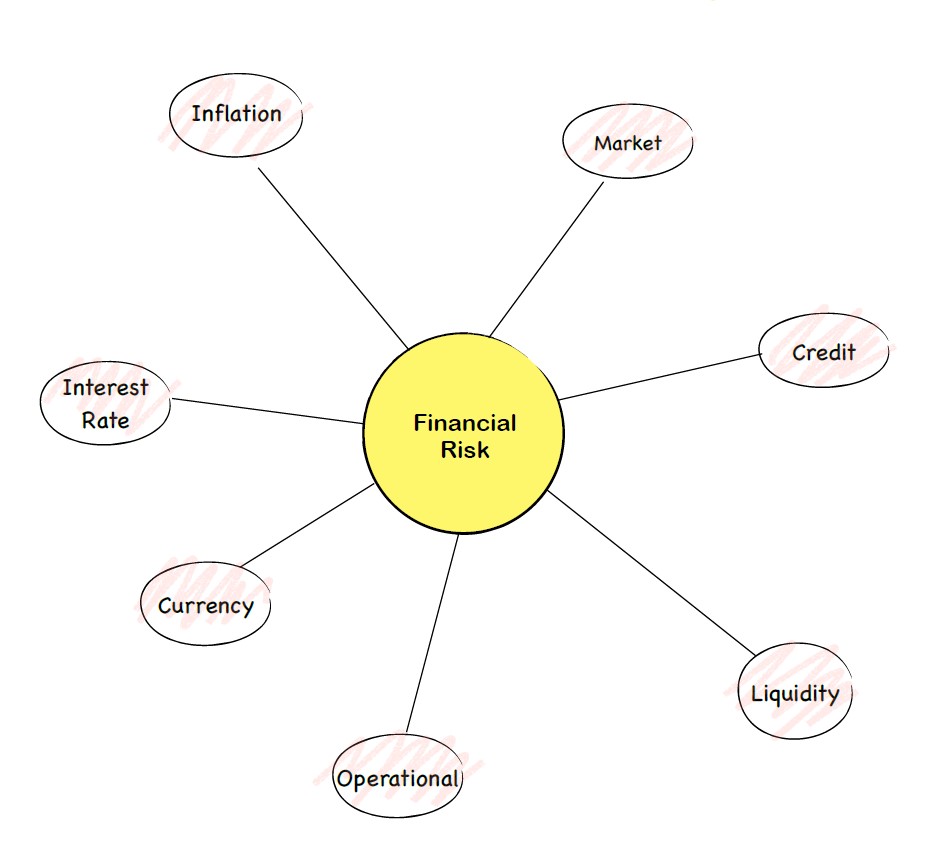

Financial risk is the uncertainty around financial markets and investments that results from a variety of variables that may have a negative financial impact. It is the potential for investing money and either losing some or all of it or not getting the projected returns because of some unforeseen circumstances. There can be different types of Financial Risks involving credit, liquidity, operational etc. Let’s look at the different types of financial risks and their meanings.

Types

- Market Risk– Market risk is the risk related to the overall financial market and how it affects assets. It is also known as systematic risk or undiversifiable risk. It represents the possibility for investment value losses brought on by different circumstances and events that have an impact on the financial markets as a whole. Diversification cannot completely remove market risk because it exists in all market scenarios. Some components of market risk include Interest Rate Risk, Commodity Price Risk, Exchange Rate Risk etc.

- Credit Risk– A risk that the borrower or debtor may not fulfill their financial commitments either by failing to pay back a loan or by complying with the terms of a contract is known as credit risk, and it is also known as default risk. Any entity that borrows money or extends credit, such as people, companies, governments, or other organizations, is subject to this risk. Credit Risk involves many components like economic conditions, collaterals, credit rating etc.

- Liquidity Risk– Liquidity is the degree to which a security or asset can be quickly and easily converted into cash without significantly changing its market price. Liquidity risk is the possibility that a person, group, or financial institution won’t be able to satisfy their immediate financial needs or operational requirements because they won’t be able to turn their assets into cash in time, without severely depreciating their market value. It results from timing issues with cash inflows and withdrawals or a dearth of quickly tradable assets.

- Operational Risk– Operational risk refers to the possibility of damage or disruption due to inadequate or unsuccessful internal procedures, systems, personnel, or other circumstances. This may involve concerns like personnel errors, computer system malfunctions, natural disasters, or even legal matters. Operational risk management focuses on detecting and controlling these risks in order to maintain a business’s smooth operations and guard against issues that can result in monetary losses or reputational harm.

- Currency Risk- Currency risk can be interpreted as a game where the value of money fluctuates. Consider a scenario in which you want to exchange some money for another currency. The fact that currency values can fluctuate is an issue. As a result, you can receive more or less of the other currency than you anticipated when exchanging your money. Businesses, investors, and even travelers who interact with multiple currencies may be impacted by this. The uncertainty and potential loss brought on by these fluctuating exchange rates and their effects on your money is known as currency risk. People frequently utilize methods like contracts to fix exchange rates in order to deal with it, or they base their decisions on their predictions of future currency values.

- Interest Rate Risk– Interest rate risk is the chance of financial gains or losses as a result of changes in interest rates. Fixed-income investments like bonds often lose value when interest rates rise, and gain value when rates fall, resulting in an inverse relation between interest rates and bond prices. Both individuals and businesses are impacted by this risk, particularly those who have loans or investments that are based on interest rates.

Interest rate risk can be described as a financial roller coaster in simpler terms. The value of certain investments may decrease as interest rates rise, and their value may increase when interest rates fall. Therefore, it’s crucial to think about how fluctuations in interest rates may affect your finances and investment portfolio. - Inflation Risk– The risk of inflation is the possibility that when prices rise, your money’s purchasing power will eventually decrease. Each rupee you have buys less as a result of increased pricing. Therefore, the danger of inflation indicates that your money may not last as long in the future, which may have an effect on your investments, savings, and overall financial situation. It’s crucial to take this risk into account while organizing your money and investment strategy.

Finally, an important aspect of efficient financial management is having a solid awareness of the many types of financial risks. Recognizing and managing these risks is crucial, whether you’re a business owner trying to preserve your operations or an investor trying to protect your capital or a student trying to keep yourself aware. You may confidently traverse the complex world of financial risk by maintaining good information and risk management practices, resulting in a more secure and profitable financial future.

-Team Risk Unplugged