In this blog we will look into three crucial terminologies which is indispensable when we talk about risk management

A Risk profile is an evaluation of an organization’s willingness and ability to take risks. It also gives a point in time assessment of the firm’s risk exposures

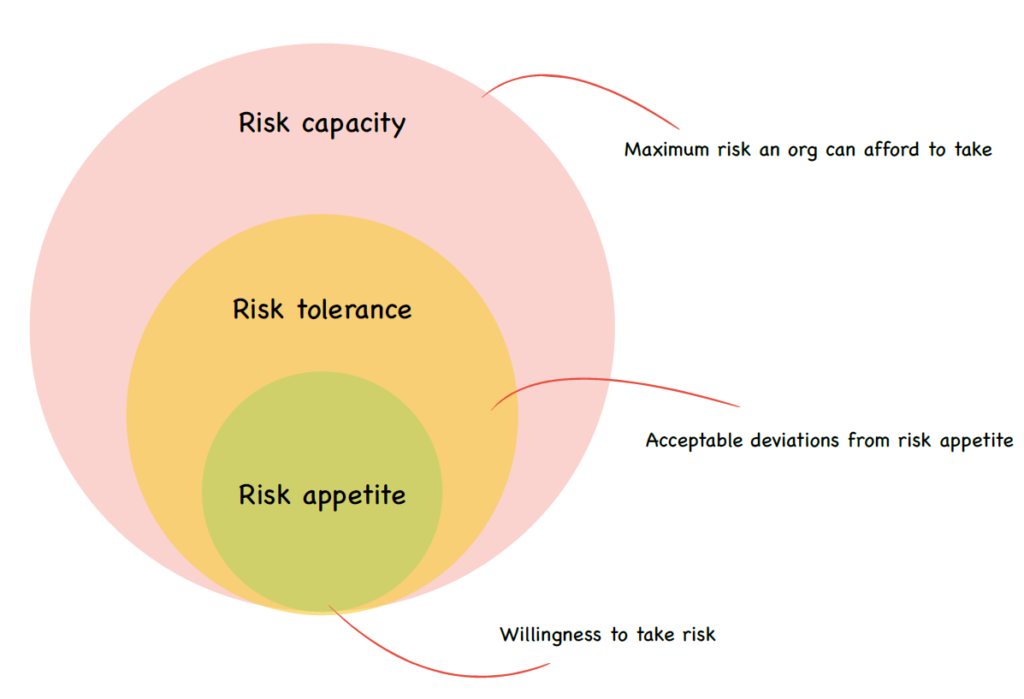

To understand more about risk profile we should be aware of the below three terminologies which is very crucial in risk management – Risk Capacity , Risk Tolerance and Risk Appetite.

Risk Capacity :

– The maximum level of risk the firm can assume, before it breaches regulatory constraints (like capital, liquidity etc), or other stakeholders constraints (like dividend pay-out etc)

Risk Tolerance :

– The acceptable deviation from the Risk appetite an organization can take to meet its long term objectives.

Risk Appetite:

– The aggregate level and types of risk a firm is willing to assume in its exposures and business activities, in order to achieve its business objectives.

Relationship between Risk capacity vs Risk tolerance vs Risk appetite:

- Risk capacity is always greater than tolerance and appetite

- Risk Tolerance are higher or equal to risk appetite but never higher than risk capacity. The Risk tolerance level tends to be closer to the Risk appetite level than the Risk capacity level

- Risk capacity is always higher than Risk tolerance and appetite

A simple Investment and returns example to help us understand these definitions:

Individual A has $ 500 as savings which he thinks can be invested in stocks and shares to create returns. Individual A considering his current situations decides to invest only $ 250 and not the whole savings. Let us understand the three terminologies using this scenario

– Risk capacity will be the total savings of the individual $ 500

– Risk appetite is the willingness to take risk which is the amount the individual is ready to invest from the savings $ 250

– Risk tolerance is the willingness to take further risk like investing 75 USD more if the market is performing well $ 325

– Team Risk Unplugged